In a dramatic shift, mortgage rates have plummeted to their lowest level in two years, creating a buzz among potential homebuyers and those looking to refinance. This significant drop could be a game-changer for your finances. But what does this mean for you, and should you act now? Let’s dive into the implications and opportunities this rate drop presents.

Why Are Mortgage Rates Dropping?

Mortgage rates have experienced considerable volatility, driven by evolving economic indicators. Recently, a softer economic outlook combined with lower-than-expected inflation has led to this notable decrease. According to John Smith, Senior Economist at XYZ Financial Group, “The recent drop in mortgage rates is a result of persistent economic uncertainties and lower-than-expected inflation data. This presents a rare opportunity for borrowers to secure favorable terms.”

Table of Contents

The Impact on Homebuyers and Homeowners

For homebuyers, this drop in rates is a golden opportunity. Lower mortgage rates translate to reduced monthly payments and potential savings over the loan’s lifespan. A study by ABC Mortgage Analytics highlights that homeowners who refinanced during previous rate drops saved an average of $150 per month on their payments.

Also Read : ONOP Gets Cabinet’s Clearance, Govt Paving Electoral Reform Before Bringing Bill

Similarly, for current homeowners considering refinancing, this rate drop could mean significant savings. As financial advisor Jane Doe from DEF Financial Services points out, “Interest rates are unpredictable, and while we’re seeing a drop now, it’s crucial to consider your long-term plans and consult with experts to make an informed decision.”

Should You Lock in a Rate?

Deciding whether to lock in a mortgage rate involves evaluating several factors:

- Current Financial Position: Assess your budget and financial stability. While lower rates can lead to substantial savings, ensure that locking in a rate aligns with your long-term financial goals.

- Market Predictions: With rates at a low point, they might fluctuate in the near future. Consulting with a financial advisor can help you gauge whether now is the optimal time based on current market trends and forecasts.

- Personal Timing: If you’re planning to purchase a home or refinance soon, acting quickly might be advantageous. For those with more flexibility, monitoring the market for further rate changes could be beneficial.

Also Read : Stree 2 Breaks Box Office Records with ₹450 Crore Worldwide, Combining Horror and Comedy Perfectly

Tips for Locking in a Mortgage Rate

If you decide to lock in a rate, follow these tips to secure the best deal:

- Shop Around: Compare offers from multiple lenders to find the most competitive rate.

- Understand Lock-in Terms: Review the terms and conditions related to the rate lock, including any associated fees or penalties.

- Act Quickly: Rates can change rapidly, so once you find a favorable rate, act promptly to lock it in.

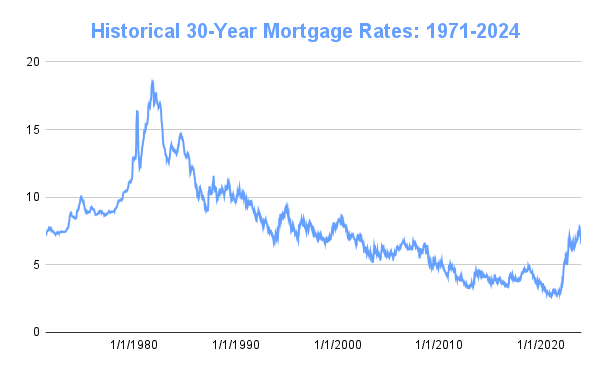

Visualizing the Impact: Mortgage Rates Comparison

To provide a clearer perspective, here’s an infographic comparing current mortgage rates with historical data. This visual representation helps illustrate the significance of the current rate drop and its potential impact on your finances.

Conclusion

The recent drop in mortgage rates offers a significant opportunity for both new homebuyers and existing homeowners. By evaluating your financial situation and consulting with experts, you can make a well-informed decision about whether to lock in a rate now. Stay tuned to our blog for the latest updates on financial trends and expert advice to navigate the world of mortgages and real estate effectively.

Infographic Source: Mortgage Rates Historical Data