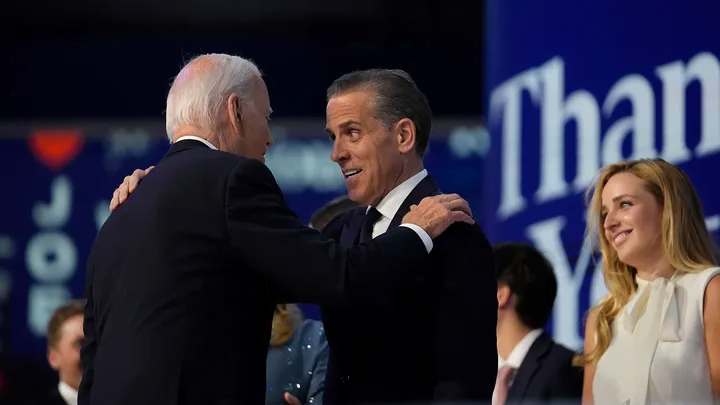

The acknowledgment of all nine federal tax charges against him has been recently made by Hunter Biden, the son of President Joe Biden. This revelation has stirred up discussions within legal circles and among federal prosecutors. Under the leadership of Special Counsel David Weiss, who is heading the investigation into Hunter Biden’s financial and tax affairs, the acknowledgment was made as part of a broader case.

Table of Contents

This acknowledgment, which occurred in a federal court in Los Angeles, represents a significant development in a case that has attracted substantial public attention.

Initially, Hunter Biden pleaded not guilty to the charges, making his sudden change of plea particularly surprising. Federal prosecutors, including Leo Wise, expressed their astonishment as this was the first indication they had of the potential switch in plea.

Hunter Biden’s Legal Troubles: A Recap

Hunter Biden has faced legal investigations for an extended period, primarily related to his financial matters and tax returns. He is facing allegations of participating in a scheme to avoid paying more than $1.4 million in federal taxes over an extended period. The Special Counsel, Weiss, claims that these activities occurred from January 2017 to October 2020, spanning the tax years 2016 to 2019.

The charges outline how Biden withdrew millions of dollars from his company, Owasco, PC, bypassing the regular payroll and tax withholding process. Instead of using these funds to pay his taxes, he allegedly used the money for a luxurious lifestyle. This sequence of events resulted in his failure to file accurate tax returns on time and the deliberate neglect of his tax responsibilities.

The Alford Plea: What It Means for Hunter Biden

The case’s potential involvement of an Alford plea is particularly interesting. In case of Alford’s plea, the accused does not confess to the crime but acknowledges that the evidence presented by the prosecution could lead to a conviction. In this scenario, the defendant agrees to the sentencing while still asserting their innocence.

Judge Mark Scarsi emphasized that the court is not required to seek the government’s approval to consider this plea. Nevertheless, DOJ federal prosecutors generally show reluctance in accepting Alford’s pleas, reserving them for “highly unusual circumstances.” Informants familiar with Weiss’ team have suggested that as of now, there is no agreement in place between Hunter Biden’s legal team and the special counsel. It seems that the defense’s strategy involves ongoing negotiations, with no final deal in place at this time.

Impact on Hunter Biden’s Rights

During the court proceedings, Hunter Biden was informed by the judge that entering a guilty plea would mean waiving his rights to a trial. This includes the right to remain silent and challenge the evidence against him. These are significant considerations in any criminal case, especially one as high-profile as this.

The decision to plead guilty could simplify the legal process, but it also comes with consequences. Should the court accept the guilty plea, He would avoid a drawn-out trial but face sentencing that could have severe implications on his future.

Charges Filed Against Hunter Biden

The charges brought against He by Special Counsel Weiss are serious, consisting of three felonies and six misdemeanors related to his failure to pay taxes. Specifically, Biden is accused of filing false tax returns and evading income taxes over multiple years.

Weiss claims that Hunter Biden deliberately avoided paying taxes despite having access to sufficient funds. In addition, Biden allegedly filed false tax returns for the 2017 and 2018 tax years, further compounding his legal issues. These charges form part of a larger narrative in which Biden misused funds from his own company while ignoring his growing tax debts.

Jury Selection Begins in Los Angeles

As of Thursday, jury selection began for the trial in Los Angeles. This marked a crucial step in the legal proceedings, with Hunter Biden and his legal team preparing to face the charges head-on. While the guilty plea could alter the course of the trial, it remains unclear what specific outcomes the court will reach regarding sentencing and possible fines.

A Second Trial Looms for Hunter Biden

This tax trial is not the only legal battle He is facing. Earlier this year, he was convicted in Delaware on separate charges related to firearms. The Delaware case involved false statements made during the purchase of a gun, possession of a firearm by a drug user, and misleading a firearm dealer. The potential 25-year prison sentence could result from these convictions, with significant fines and supervised release periods accompanying each count.

Also Read : Ukraine Politics Faces Major Upheaval as 6 Ministers Resign

Hunter Bident’s legal issues seem far from resolved, although a sentencing date for these charges has not been set yet. The federal tax case in Los Angeles will undoubtedly influence how future cases against him will be handled, and vice versa.

President Biden’s Stance on a Pardon

In light of the growing legal issues, there are rumors swirling about President Joe Biden contemplating pardoning his son. However, White House Press Secretary Karine Jean-Pierre has emphatically stated that President Biden has no plans to pardon him.

When directly questioned, Jean-Pierre emphasized that the answer remains a firm no. President Biden’s decision to refrain from getting involved in his son’s legal affairs indicates that Hunter Biden will have to deal with the repercussions of his actions without the president’s intervention. This stance might be carefully planned, as the president has repeatedly stressed his administration’s independence from ongoing probes.

What’s Next for Hunter Biden?

As the legal proceedings move forward, Hunter Biden’s future remains uncertain. His guilty plea to the federal tax charges is a pivotal moment, but it does not mark the end of his legal challenges. Sentencing for the tax charges is set for December 16, and He remains free on bond until then.

The complexities surrounding his defense strategy, the possibility of an Alford plea, and the ongoing negotiations between his legal team and the special counsel indicate that much remains in flux. As both the tax trial and the Delaware gun case continue, He faces significant legal consequences that could alter the course of his life.

Conclusion

Hunter Biden’s decision to plead guilty to federal tax charges represents a critical juncture in his long-standing legal battles. The special counsel’s allegations of tax evasion, combined with ongoing issues related to firearms charges, place the president’s son in a precarious legal position. As the legal process continues to unfold, the broader implications for Him and his family remain to be seen.

FAQs

What charges is Hunter Biden facing?

He is facing federal tax charges for evading over $1.4 million in taxes, along with other financial-related felonies and misdemeanors.

What is an Alford plea?

An Alford plea allows a defendant to accept a sentence without admitting guilt, acknowledging that the evidence could lead to a conviction.

Will President Biden pardon Hunter Biden?

No, President Biden has publicly stated he will not pardon his son.

When is Hunter Biden’s sentencing?

He is scheduled to be sentenced on December 16, 2024.

Is Hunter Biden facing other legal cases?

Yes, He was convicted in a separate gun-related case earlier this year in Delaware.