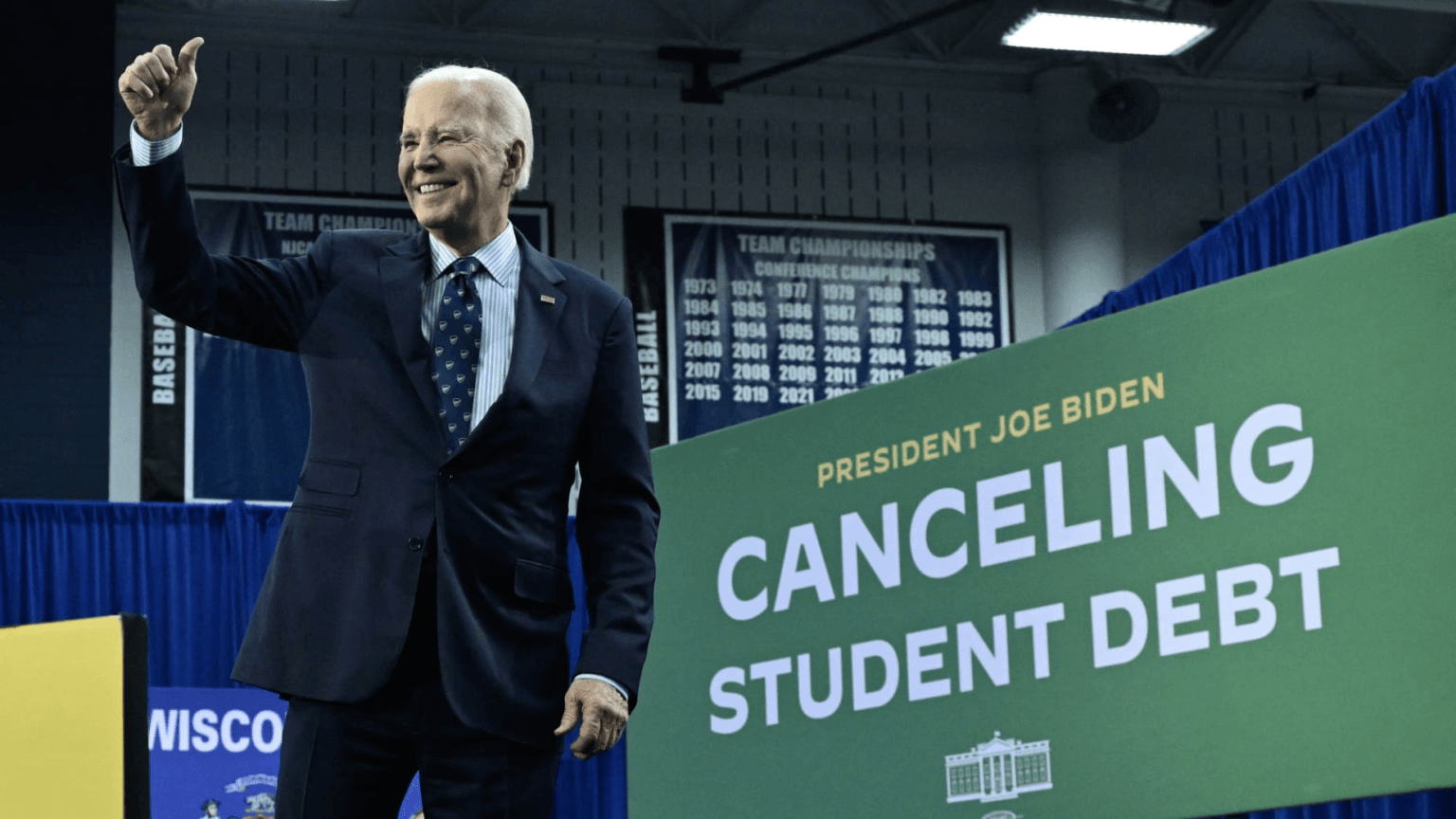

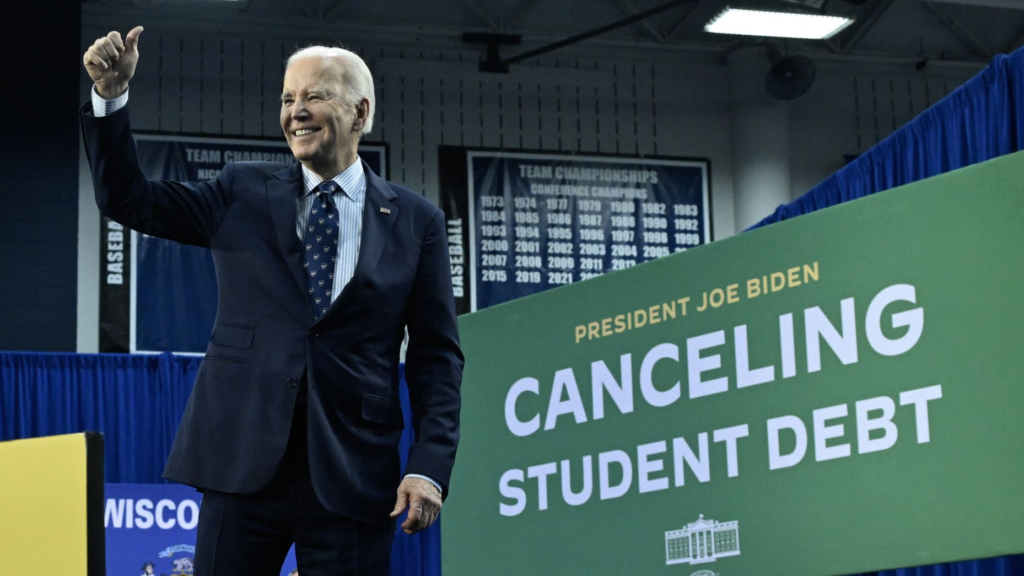

The Biden administration is moving ahead with a revamped student loan forgiveness plan after facing legal setbacks earlier in the year. This new strategy, introduced following the Supreme Court’s rejection of an earlier plan, aims to provide relief to millions of borrowers, particularly those under financial hardship.

On October 3, 2024, the administration confirmed the launch of this plan, marking a significant step in addressing the $1.7 trillion student debt crisis.

Key Aspects of the Student Loan Forgiveness Plan

The latest plan under President Biden focuses on a more targeted approach to student loan forgiveness. It aims to help low-income borrowers, those who attended underfunded institutions, and individuals in public service. The administration’s actions include restructuring payment plans, increasing income-driven repayment options, and introducing caps on monthly payments to ease the burden on borrowers.

A major feature of this plan is a reduction in monthly payments based on income levels, ensuring that no borrower pays more than 5% of their discretionary income. This reform is expected to reduce the financial strain on low- to middle-income borrowers, many of whom have struggled with repayment amid rising living costs and economic uncertainty.

Biden’s Strategy Amidst Legal Battles

After the Supreme Court blocked the original $400 billion student loan forgiveness initiative earlier in 2024, the Biden administration quickly pivoted, adopting a new, narrower legal framework. This revised approach works within the Higher Education Act to offer targeted relief and sidestep the legal challenges that previously derailed broader efforts.

Despite these efforts, legal challenges continue. Conservative lawmakers and interest groups have criticized the plan, arguing that it oversteps executive authority and places an unfair burden on taxpayers. However, the administration remains committed to addressing the student debt crisis, stating that financial relief for millions of Americans is both necessary and achievable through executive action.

Impact on Borrowers

If successful, Biden’s student loan forgiveness plan could affect more than 20 million borrowers, many of whom are currently facing repayment deadlines after a prolonged pandemic pause. Interest on federal student loans resumed in September 2023, and payments began in October 2024 after a nearly three-year pause due to COVID-19. The administration has prioritized reaching out to those most affected by the economic downturn, particularly borrowers with low incomes and individuals working in public service fields.

For these borrowers, the plan offers significant relief, potentially eliminating a large portion of their outstanding debt or significantly lowering monthly payment obligations. Education Secretary Miguel Cardona has expressed confidence in the plan’s success, highlighting the positive impacts on individuals who have struggled to manage their student loan payments amid other financial pressures.

Political Repercussions

The student loan forgiveness issue has become a highly polarized political topic. While Democrats largely support Biden’s efforts to provide relief, Republicans remain critical, citing concerns over government spending and fairness. The 2024 election cycle has seen candidates on both sides of the aisle address the student debt crisis, with Republicans focusing on market-based solutions and Democrats calling for broader reforms to higher education financing.

Also Read : Jack Smith Challenges Trump’s Election Defense with New Legal Brief: A Deep Dive

Biden’s plan is seen as a key element of his 2024 campaign, offering a direct response to a major issue facing young voters and lower-income Americans. The administration’s focus on addressing income inequality and offering targeted financial relief aligns with broader Democratic goals of reducing economic disparity. However, continued legal battles and public opposition from conservative lawmakers could hinder the plan’s full implementation.

Looking Ahead: What’s Next for Borrowers?

While the Biden administration is pushing forward with the new plan, borrowers remain uncertain about the future. Legal challenges are expected to continue, and some portions of the plan could be blocked or delayed in court. Borrowers are encouraged to stay informed about any changes to their repayment plans and to explore available options such as income-driven repayment programs and public service loan forgiveness initiatives.

For now, the administration’s focus remains on providing as much relief as possible through executive actions, even as lawmakers debate the long-term solutions to the student debt crisis. Borrowers are advised to monitor updates from the Department of Education and review their individual loan statuses to take advantage of new opportunities for forgiveness and reduced payments.

FAQs: Understanding Biden’s Student Loan Forgiveness Plan

Q1: Who qualifies for the student loan forgiveness plan?

The plan targets low-income borrowers, those in public service jobs, and individuals who attended underfunded institutions. Income-driven repayment options are also available.

Q2: How does the income-driven repayment plan work?

Borrowers will pay no more than 5% of their discretionary income on student loans under the new plan, potentially reducing monthly payments.

Q3: What legal challenges does the plan face?

The plan has faced lawsuits from conservative groups and lawmakers who argue that the president does not have the authority to implement such widespread relief.

Q4: How does this plan differ from Biden’s original forgiveness plan?

The new plan is narrower in scope, focusing on targeted relief for specific groups of borrowers, unlike the broader $400 billion initiative that was blocked by the Supreme Court.

Q5: Will payments continue to be paused under this plan?

No, payments have resumed as of October 2024 after a pause that began in 2020. However, borrowers can explore reduced payment options.

Q6: How many borrowers will benefit from this plan?

The Biden administration estimates that over 20 million borrowers could see relief through the new plan.

- How to Stay Healthy During Flu Essential Tips for Every Family

- Satyapal Malik Death on 5 Aug 2025: Political Legacy That Shaped Indian Public Life

- Growing Legionnaires’ Disease Outbreak in NYC’s Harlem Claims Two Lives, Sickens Over 58

- Non-Alcoholic Drink Beer: fresh Alternative with a Unique Appeal

- Meet the Harley-Davidson X440: The Ultimate Desi Roadster

- OnePlus Pad 3: The Android Tablet That Wants Your Laptop’s Job