Hyundai’s initial public offering (IPO) on October 22, 2024, has generated significant buzz, with stocks performing impressively in early trading sessions. Hyundai’s IPO was highly anticipated, following a period of strong growth and expansion in the automotive and technology sectors.

Investors were eager to see how the company, with its increasing focus on electric vehicles (EVs) and global market penetration, would fare in the stock market.

in this Article

Hyundai’s Stock Market Debut

The IPO witnessed a remarkable response from investors, highlighting the confidence in the future growth trajectory. The strong market debut was driven by several factors, including the company’s solid financial performance, innovation in the EV space, and expansion into autonomous vehicles and smart mobility technologies. The overwhelming demand for shares also reflected broader investor enthusiasm toward companies shifting toward sustainable and futuristic automotive technologies.

During the initial trading hours, Hyundai’s share price surged, surpassing expectations set by market analysts. Early indicators suggested that the company’s stock could maintain momentum, positioning itself as one of the leading automakers in the stock market for 2024.

Growth of Electric Vehicles and Sustainability Initiatives

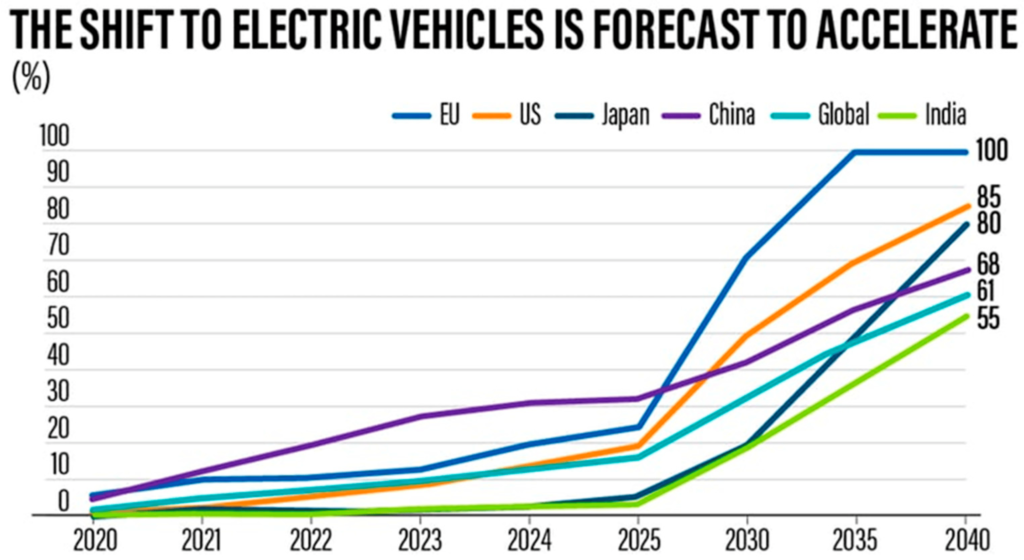

A significant part of Hyundai’s appeal in this IPO stemmed from its advancements in electric vehicles. The company’s commitment to reducing carbon emissions and promoting green energy solutions has resonated with environmentally-conscious investors. Their EV lineup, including models like the Ioniq 5 and Ioniq 6, is recognized for its competitive edge in terms of range, design, and technology.

With governments worldwide tightening emissions regulations, Hyundai’s focus on producing eco-friendly vehicles offers it an edge in the global market. The company has pledged to increase its investment in EV research and development, particularly in battery technology, aiming to become a global leader in sustainable mobility.

The automaker’s foray into hydrogen-powered vehicles is another bold move toward diversification. Hyundai has established itself as a pioneer in hydrogen fuel cell technology with vehicles like the NEXO SUV. This growing portfolio of green technology has attracted investors seeking opportunities in the future of mobility.

Strategic Expansion and Partnerships

Hyundai’s stock market success is also underpinned by its strategic expansion and partnerships. The company has made significant strides in markets across North America, Europe, and Asia, with plans to increase production capacity for EVs globally. Collaborations with tech giants and startups in the autonomous vehicle sector have also positioned Hyundai as a forward-thinking company.

One notable partnership is with U.S.-based self-driving technology firm Aptiv, forming a joint venture to develop autonomous vehicle technology. Hyundai’s investments in smart city projects and artificial intelligence (AI) for connected cars have attracted investors who see potential in the convergence of automotive and tech industries.

This strategic direction has allowed Hyundai to diversify its business beyond traditional auto manufacturing, appealing to investors focused on long-term innovation and market disruption.

Financial Performance and Future Outlook

Financially, Hyundai has demonstrated robust performance over the last year, despite challenges posed by global supply chain issues and inflationary pressures. The company’s revenue from EVs, internal combustion vehicles, and its various subsidiaries has been growing steadily. Analysts have projected further growth as the company capitalizes on emerging markets, particularly in the EV segment.

Looking forward, Hyundai’s future in the stock market looks bright. The automotive giant has outlined ambitious goals for the next decade, including plans to expand its EV production capabilities and increase the market share of hydrogen-powered vehicles. As the demand for cleaner energy and smart mobility solutions rises, Hyundai is well-positioned to meet these needs, ensuring strong returns for its shareholders.

Investor Sentiment and Market Reactions

Market reactions to Hyundai’s IPO have been overwhelmingly positive. The company’s commitment to innovation, particularly in green and autonomous technologies, has attracted a wide range of investors. Institutional investors, in particular, have shown strong interest, highlighting Hyundai’s potential as a long-term growth stock.

Also Read : Bajaj Housing Finance IPO: Price range ₹66 to ₹70 per shareRetail investors also participated actively in the IPO, capitalizing on Hyundai’s solid reputation and optimistic future outlook. With the global transition toward cleaner energy sources and the growing need for smart transportation, Hyundai is seen as a key player in shaping the future of mobility.

However, as with any stock market listing, there are risks involved. Investors have raised concerns about global economic volatility, rising material costs, and the impact of geopolitical tensions on the automotive industry. Nonetheless, Hyundai’s strong fundamentals and innovative business strategies make it a promising contender in the competitive market.

Conclusion

Hyundai’s IPO debut has cemented the company’s reputation as a major player in the automotive and technology sectors. With a strong focus on electric vehicles, sustainable energy, and smart mobility solutions, the automaker is well-positioned to capitalize on the future of the automotive industry. The positive market reaction to its IPO reflects growing investor confidence in Hyundai’s ability to innovate and lead in the coming years. As the company continues to expand its portfolio and global reach, investors can look forward to promising returns and long-term growth opportunities.

FAQs

1. What was Hyundai’s focus for the IPO?

Hyundai’s IPO centered on its advancements in electric vehicles, hydrogen technology, and smart mobility solutions.

2. How did Hyundai’s stock perform on its market debut?

Hyundai’s stock performed well during its market debut, with shares experiencing a strong surge, reflecting investor confidence in the company’s future growth.

3. What factors drove Hyundai’s stock market success?

The success was driven by Hyundai’s innovation in electric and hydrogen vehicles, strategic partnerships, and focus on future technologies like autonomous driving.

4. What is Hyundai’s outlook in the electric vehicle market?

they has ambitious plans for expanding its EV production and aims to become a leader in sustainable mobility by investing heavily in green technologies.

5. Are there any risks associated with investing in Hyundai?

While the shows strong potential, risks include global economic challenges, rising material costs, and geopolitical tensions affecting the automotive industry.

- How to Stay Healthy During Flu Essential Tips for Every Family

- Satyapal Malik Death on 5 Aug 2025: Political Legacy That Shaped Indian Public Life

- Growing Legionnaires’ Disease Outbreak in NYC’s Harlem Claims Two Lives, Sickens Over 58

- Non-Alcoholic Drink Beer: fresh Alternative with a Unique Appeal

- Meet the Harley-Davidson X440: The Ultimate Desi Roadster

- OnePlus Pad 3: The Android Tablet That Wants Your Laptop’s Job